Some things come just in time, literally. The Indiana Department of Revenue’s (DOR) much-anticipated technological transformation launched the first of four rollouts today. The biggest feature of this rollout is the new online e-services portal—the Indiana Taxpayer Information Management Engine, branded as INTIME, which enables Hoosiers to manage their taxes in one convenient location 24/7.

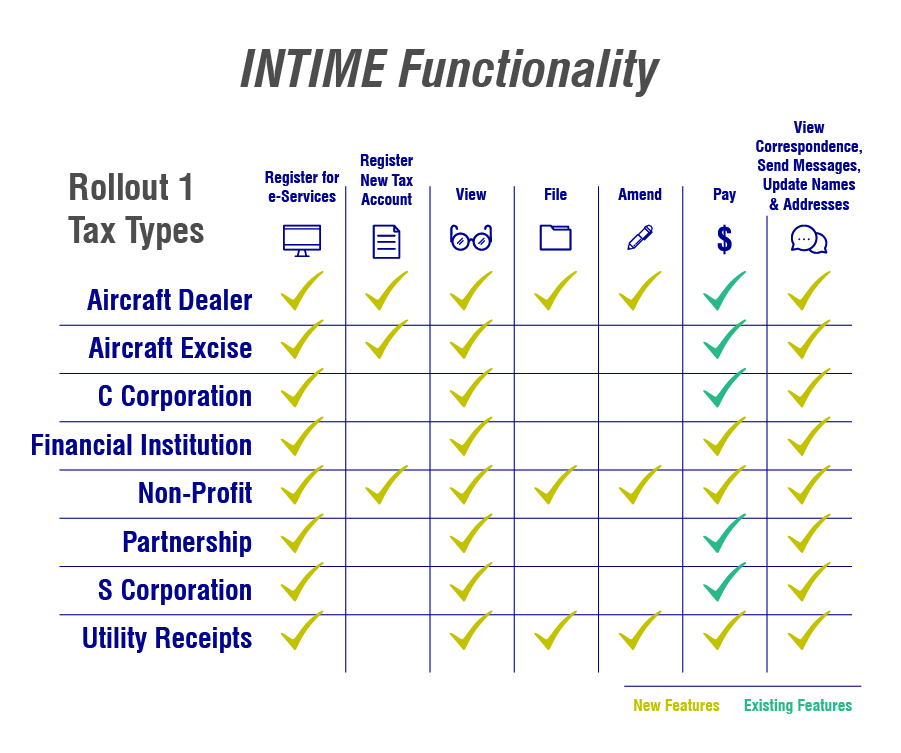

This customer-facing portal is part of Project NextDOR, the agency’s multi-year modernization effort, which will completely replace the current system used to process taxes. Today’s launch is the first of four rollouts over a four-year span, specifically affecting the following tax types:

- Aircraft Dealer

- Aircraft Excise

- C Corporation

- Financial Institution

- Non-Profit

- Partnership

- S Corporation

- Utility Receipts

“Indiana has been long overdue for an upgrade to our tax processing system to better serve Hoosiers and keep up with advancing technology— today’s successful launch of Rollout 1 of Project NextDOR, especially the INTIME portal is a major milestone for this agency,” said Commissioner Adam Krupp.

“Governor Holcomb’s fifth pillar of his Next Level agenda for Indiana is to provide great government service at a great value to taxpayers, and we believe DOR is supporting that agenda through Project NextDOR. Hoosiers need to feel confident in DOR’s ability to serve them at the highest levels of efficiency and in a cost-effective manner. Once fully implemented, Project NextDOR and our INTIME portal will enhance our ability to do exactly that.”

Indiana’s current tax processing system has been in place for roughly 25 years and presents many processing challenges, inefficiencies and limitations for both DOR and Hoosier taxpayers. Simple requests, such as access to tax transcripts, are not possible with the current software. Project NextDOR’s new technology will bring Indiana into the modern era of revenue services and support future best practices.

The key features of the new system upon completion include:

- An enhanced online customer portal, INTIME, to allow Hoosiers to view past payments and returns.

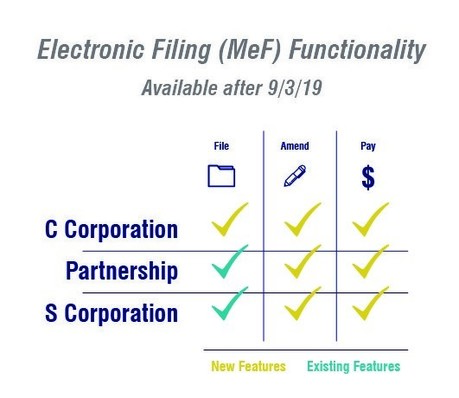

- Electronic filing of tax returns and payments that are currently submitted via paper.

- The ability to file amended returns electronically.

- Validation and transparency of revenue disbursements and reporting to local units of government.

Another new feature is INTIME’s option to submit an electronic Power of Attorney (or ePOA) to streamline the establishment of third-party relationships such as lawyers, accountants and family members.

“Over the last year, DOR has collaborated with tax practitioners around the state to address the complexities of submitting a Power of Attorney,” said Commissioner Krupp.

As with any new program, DOR has taken the extra step to take care of customers during this time of transition. DOR has dedicated Customer Service Representatives available to help all customers and tax practitioners with their INTIME questions. Customers are encouraged to call 317-232-0129 and select option “1” for all questions regarding INTIME.

In addition, DOR has created a Practitioner Quick Start Guide and video tutorial to walk customers through the process of registering for the INTIME e-services portal while also providing helpful tips to ensure an easy transition into the new system. This guide and other helpful resources are available at www.ProjectNextDOR.dor.in.gov.

INTIME can be found online by visiting DOR’s website at https://intime.dor.in.gov/.

Indiana Department of Revenue (DOR)

Mission: To serve Indiana by administering tax laws in a fair, secure and efficient manner.

Vision: To be recognized as the premier tax administrator in the nation and a great place to work.